New “Partner with a Payer” Video Highlights Important Collaboration with Archery Manufacturers and Wildlife Agencies

NSSF

®, The Firearm Industry Trade Association, in partnership with TenPoint Archery, Archery Trade Association, the Ohio Department of Natural Resources and the U.S. Fish and Wildlife Service, has released another film in the “

Partner with a Payer®” series—a collection of videos highlighting the importance of wildlife conservation and management. The Partner with a Payer Program connects the dots from how excise tax dollars are generated to how they are used to sustain healthy wildlife populations.

https://youtu.be/4Y1mCr8Kcoo

The

latest video, “Conservation Success at the Crossroads of Collaboration,” highlights the work being done to continue providing public access to target ranges, hunting opportunities and other outdoor experiences within the United States.

Funding Conservation: A Collective Effort

In the heart of collaborative efforts between firearm industry leaders, archery manufacturers, and wildlife conservation agencies lies an important component for hunters and target shooters alike – the Federal Aid in Wildlife Restoration Act, also known as the Pittman-Robertson Act. This act mandates excise taxes, a financial contribution by firearm and ammunition manufacturers on their products, as well as archery equipment manufacturers, to fund wildlife conservation and management programs across the United States.

Representatives from the Ohio Department of Natural Resources, National Shooting Sports Foundation, Archery Trade Association and USFWS came together to tour the TenPoint Archery Facility, where they learned what it takes to generate the excise tax revenues supporting wildlife populations across the country. Throughout the tour, state and federal agency staff discussed specific projects and key instances where funds provided opportunities for the public to hunt, target shoot and enjoy the diverse wildlife in the United States.

[caption id="attachment_53686" align="aligncenter" width="550"]

Excise taxes fund wildlife research for the sustainable maintenance of healthy wildlife populations.

Excise taxes fund wildlife research for the sustainable maintenance of healthy wildlife populations.[/caption]

The excise taxes established under the Pittman-Robertson Act have been a driving force, contributing over $16.4 billion (over $25 billion adjusted for inflation) to individual states. In this video, Peter Novotny, Deputy Chief of the Ohio Division of Wildlife, highlights how these funds, combined with hunting and fishing license dollars, fund essential wildlife research. This research enables a deeper understanding of how wildlife populations adapt to a changing environment, ultimately leading to the maintenance of healthy and sustainable populations.

The Ripple Effect for Hunters and Shooters

For hunters and target shooters, the implications of excise taxes are far-reaching. The funds derived from these taxes play an important role in maintaining shooting ranges, archery facilities, and wildlife habitats, ensuring a rich and diverse outdoor experience. The collaborative efforts between industry leaders, state agencies, and federal organizations exemplify the commitment to sustaining the North American Model of Wildlife Conservation.

[caption id="attachment_53687" align="aligncenter" width="550"]

“We feel comfortable and confident that the excise tax dollars are helping keep healthy deer herds out there across the United States,” said Phil Bednar, President and CEO of TenPoint Crossbows.

“We feel comfortable and confident that the excise tax dollars are helping keep healthy deer herds out there across the United States,” said Phil Bednar, President and CEO of TenPoint Crossbows.[/caption]

As hunters and target shooters, your passion and participation directly contribute to the preservation of the outdoor experiences you cherish. These excise taxes not only support wildlife conservation but also create a legacy of responsible and sustainable outdoor recreation for generations to come. Understanding and appreciating this cycle of giving back ensures that the great outdoors remains accessible for all.

More info and resources at https://www.nssf.org/partner-with-payer/

See other Partner with a Payer Videos:

https://www.letsgohunting.org/resources/articles/game-birds/osprey-restoration-understanding-excise-taxes-wildlife-conservation/

https://www.letsgohunting.org/resources/articles/explore-hunting/how-do-excise-taxes-benefit-hunter-education-clark-county-shooting-complex/

Excise taxes fund wildlife research for the sustainable maintenance of healthy wildlife populations.[/caption]

The excise taxes established under the Pittman-Robertson Act have been a driving force, contributing over $16.4 billion (over $25 billion adjusted for inflation) to individual states. In this video, Peter Novotny, Deputy Chief of the Ohio Division of Wildlife, highlights how these funds, combined with hunting and fishing license dollars, fund essential wildlife research. This research enables a deeper understanding of how wildlife populations adapt to a changing environment, ultimately leading to the maintenance of healthy and sustainable populations.

Excise taxes fund wildlife research for the sustainable maintenance of healthy wildlife populations.[/caption]

The excise taxes established under the Pittman-Robertson Act have been a driving force, contributing over $16.4 billion (over $25 billion adjusted for inflation) to individual states. In this video, Peter Novotny, Deputy Chief of the Ohio Division of Wildlife, highlights how these funds, combined with hunting and fishing license dollars, fund essential wildlife research. This research enables a deeper understanding of how wildlife populations adapt to a changing environment, ultimately leading to the maintenance of healthy and sustainable populations.

“We feel comfortable and confident that the excise tax dollars are helping keep healthy deer herds out there across the United States,” said Phil Bednar, President and CEO of TenPoint Crossbows.[/caption]

“We feel comfortable and confident that the excise tax dollars are helping keep healthy deer herds out there across the United States,” said Phil Bednar, President and CEO of TenPoint Crossbows.[/caption]

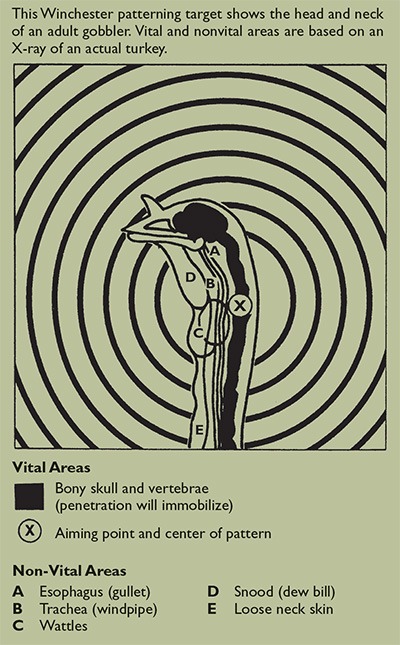

Turkeys make a tough target. They are difficult to see and even harder to harvest. The head and neck are the only vital areas that ensure a fast, clean hunt, but this will only happen if your shotgun throws a tight, dense shot pattern.

The best shotgun choice for turkeys is a 12-gauge magnum, though the 10 gauge is gaining some ground among turkey hunters. The best shot sizes are No. 2, 4, 5, or 6. The best shotgun chokes are Full, Extra Full, and Super Full.

Turkeys make a tough target. They are difficult to see and even harder to harvest. The head and neck are the only vital areas that ensure a fast, clean hunt, but this will only happen if your shotgun throws a tight, dense shot pattern.

The best shotgun choice for turkeys is a 12-gauge magnum, though the 10 gauge is gaining some ground among turkey hunters. The best shot sizes are No. 2, 4, 5, or 6. The best shotgun chokes are Full, Extra Full, and Super Full.